-

Here

- Home >> News >> Industry News

Here

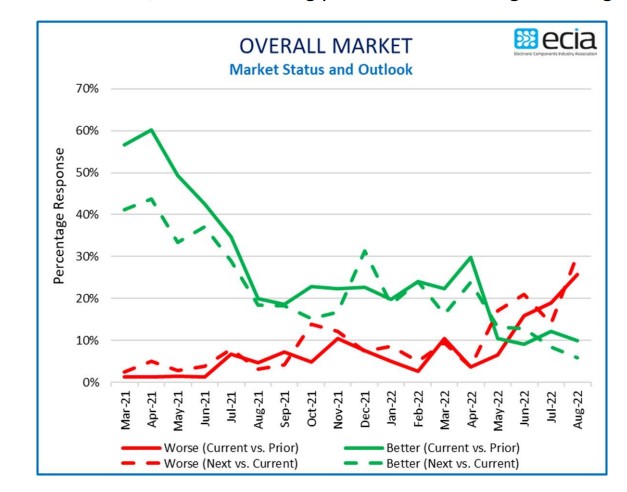

It’s hard to ignore the signals in the components market that the second half of the year is going to be grim. In August, ECIA’s component sales-trend index dropped to its lowest level in two years. Memory suppliers Samsung, SK Hynix and Micron have drastically cut their forecasts.

At the same time, distributors still see demand outstripping supply and OEMs are still waiting for the “golden screw” that will complete work-in-process.

The state of the semiconductor shortage, according to Tim Fiore, chair of the ISM’s manufacturing survey, “depends on who you ask.” The breadth of semiconductor products in the market virtually guarantees that at any given time some devices will be scarce while others are plentiful, experts point out.

Notably, the semiconductor segment ran counter to overall ECIA sales trends last month. The Electronic Component Sales Trend Survey (ECST) for August dropped to 86.0 from 94.7 in July. Any number below 100 indicates negative growth.

“Expectations go from bad to worse as the industry moves through the second half of 2022,” said Dale Ford, chief analyst for ECIA. The one relative bright spot is the expected stabilization of market sentiment in September as the outlook calls for a level of 88.4.

Source: ECIA

The index for semiconductors remained stable between July and August and showed a surprising jump to 100 for the September outlook, ECIA reported. EM and passives forecasts for September average about 82.

End-market sentiment in August was even worse than the component index. On a quarterly basis, every market segment, except for military/aerospace, is in solidly negative growth territory in both the August and Q3 ECST reports. Industrial electronics fell to 90; the mobile phone, computer and consumer market remain weak. The automotive and medical electronics indexes range between 90 and 95.

The economic environment appears to be the main contributor to the declining prospects for electronic component sales, according to Ford. The normal cyclical behavior of the market comes into play, but the downward side of the cycle has been reinforced strongly by the economy. If the typical pattern of the electronic component cycle prevails, it would be expected that the second half of 2022 will mark the beginning of an extended period of weak sales.

Likewise, IC Insights noted much of the current IC weakness is due to economic concerns caused by rising inflation, ongoing supply chain disruptions and from suppliers and OEMs working to reduce IC inventory levels.

Still, these trends are having a positive effect on lead times. The percentage of ECIA survey participants seeing declining lead times in the passive and EM segments grew from 15 percent to 23 percent between July and August. Those seeing increased lead times dropped from 23 percent to 12 percent. Passives followed the same trend with expectations for declining lead times moving from 25 percent to 30 percent between July and August.

Semiconductor lead time expectations moved in the opposite direction as those expecting increases jumped while those seeing declines fell.

One of the great unknowns in the supply chain is the level of inventory OEMs and EMS providers are sitting on. Several chip makers and fabs have noted order cancellations in the past few months. Analysts predict the close of calendar Q3 — when everyone tries to offload inventory — will clarify things.